How much rent can I afford?

6th December 2023

8.5 million UK households rent, and now, you are considering it too. So, we want to transform this process into a straightforward and stress-free experience by sharing with you our guide on how to create a budget for renting.

In this guide, we have filled it with the best of the very best on what to consider when calculating your overall costs, and how to determine what is an affordable amount of income to allocate towards rent, while still leaving you with plenty of money to go out for drinks at the pub, take the family out to the waterpark for the day or order a full English breakfast with a latte with your mates whenever you want without worrying about the bill.

We have also kept in mind that it does not matter if you’re a first-time renter, an experienced tenant or someone who wants to share this with a family member or friend who is thinking about renting, we have created this for all: to build confidence and share our knowledge. By doing so, you get to focus on what’s important: finding the right property for you!

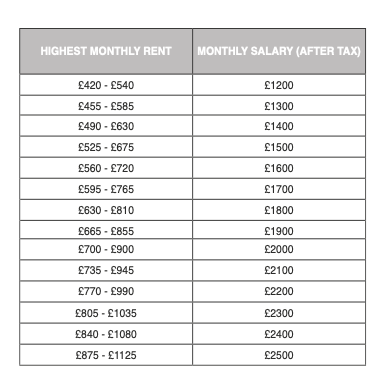

According to recent statistics, the average monthly rent for a 1-bedroom apartment in the South East England is £765, while a 2-bedroom apartment costs around £1,029 per month. Ideally, you want to spend no more than 30% of your income on rent and in fact, to be able to pass referencing most reference providers require you to earn at least 30 times the monthly rent.

To make your life easier versus Googling away different numbers on your screen and leaving you to fend for yourself, check out our chart below. It is based on advice directly from Halifax. It shows the rent you may expect to pay based on your salary after tax. As a benchmark, 35-45% of your after-tax income is spent on rent.

Which bill should I take into consideration?

There are other bills to keep in mind too, some you might be responsible for and others your landlord are. Before signing anything, ask for clarification. What you are expected to pay and what is included?

1. Water and sewage

For instance, water and sewage might be included as an extra or included in your rent. You won’t know unless you ask upfront. On average, water and sewage combined together costs around £34 a month. For water, the average monthly bill is £17. For sewage, the average monthly bill is the same. To reduce your water bill, think about taking shorter showers, and running the washing machine only when full.

2. Council tax

Council tax is paid monthly in England, Scotland, and Wales. You can find your tax on the local council’s website and on estate agent’s website in propertie’s details. For instance, for Southampton Band A, the council tax is £1,372.24.

For Southampton Band H, the council tax charge is £4,116.72. This might be broken down into monthly payments if your landlord expects you to contribute to this.

3. Gas and electricity

In 2021, the average UK household spent £111.61 per month on gas and electricity. In 2022, the amount jumped to £182 per month. In 2023, this amount is expected to be even higher. Take a look at a properties EPC to get an idea of how energy efficient the property is and get an idea of potentially what the bills may be. This can of course vary quite a lot depending on how many people will be living in the property and how often you are at home.

4. Service charges

A service charge will not usually be your responsibility as the landlord tends to cover this.

5. Charges for keeping a pet

We love our four-legged family members, but, landlords might charge a higher level of rent to cover any potential damage caused or to cover any expenses needed to ensure your rental home/flat is returned in the same condition when you moved in. Make sure to ask about it or if there are any pet restrictions before signing a lease agreement to avoid any surprises down the line.

6. Car expenses

Other monthly expenses to consider are just monthly expenses you have. For instance, if you own a car then your road tax, MOT, car insurance, and fuel fall into this category. Also, any outstanding debts, credit card payments, and loans.

Don’t forget commuting costs to and from your new rental. If you have your own vehicle, fuel costs are currently an average of £1.60 per litre. If you are happy to, and looking to reduce your carbon footprint, think about using a bicycle, scooter or using a city rental bike.

7. Childcare costs

Also, if you pay for childcare then count that towards your monthly spend. Childcare/nursery costs are approximately £263 a week so you need to add that too. Remember to include gym memberships, monthly subscriptions (Netflix, Amazon Prime), medicine prescriptions, clothes, groceries, dining out, and nights out (out out).

How to calculate how much rent I can afford?

So, now that you have thought about your outgoings, subtract them from your income, after taxes. Then, from that amount, outline how much you can easily spend on rent and how much you can save each month. During this process, take into account unexpected expenses which can pop up (e.g. emergency car repairs or unexpected bills).

When looking for accommodation, consider your search area (location, location, location). Properties in city centres or popular areas tend to be more expensive than those in quiet suburbs or rural areas. If you’re on a tight budget, it might be worth looking for a rental further away from your workplace or city centre to save on rent.

Another factor to consider is the type of property to look for. Studio apartments tend to be cheaper than 1 bedroom apartments. Also, sharing a house with other people reduces costs on rental and utilities.

Lastly, just a friendly reminder, before you sign your tenancy agreement, plan for upfront costs. If you’re moving, these costs can include a rental deposit and removal fees. Also, if you’re renting an unfurnished place, account for furniture and soft furnishings (e.g. curtains). In England, letting agents or private landlords are not allowed to charge admin fees, so, you don’t need to worry about that.

Now that you’ve worked out how much rent you can afford, with that number in mind, set the maximum rental price on our property search page to find a place that fits your finances. Check it out here.

If you get stuck, need guidance or have any questions then call us. We’re happy to help anytime! We have inside knowledge about locations, properties, local schools, and public transport available in your ideal search area. And, now armed with this newfound budget skills and info, find your new place with peace of mind. Happy searching!

Spread the news...

Part of the Charters Group

Part of the Charters Group